AIS

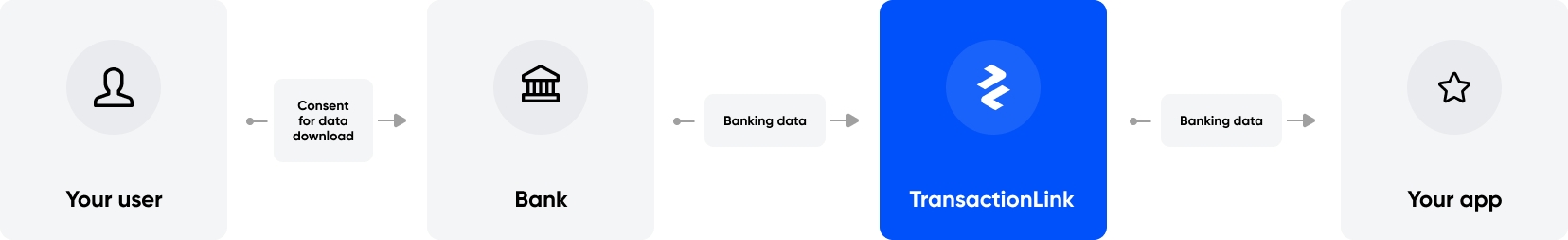

How does it work?

Upon your user consent, TransactionLink connects to their bank to download their data.

More about this service you can find here

Configuration: Redirect and embedded

The AIS app can be configured to follow two different flows. Every flow returns different data, and it's up to you to decide which one suits your use-case.

The redirect flow

In this flow the user is redirected to the bank's website, where he consents for the data download. This flow is the most common choice as it provides more robustness. However, it doesn't provide detailed personal data like personal identity number, so it's KYC capabilities are limited.

The embedded flow

In this flow all the interactions happen within TransactionLink's widget. The data download happens only once and transactions history is limited to three months. On the other hand you're able to get more of the personal data for example identity number.

Supported banks

To check the list of supported banks please go to this section.

Response Content

AIS:

status

String

Integration result status: One of possible values:

COMPLETE- completed with successTIMEDOUT- timeout occured due to no user activity on widgetOMITTED- user selected that his bank is not available and AIS task was omitted

code

String

Code related with status: One of possible values:

bank.notFound- User bank was not found on available bank list

Identity:

firstName

String

First name of the person

lastName

String

Last name of the person

personalIdentityNumber

String

Personal Identity Number of the person

personAddresses

Object

Object containing person's addresses

citizenship

String

Citizenship of the person

gender

String

Gender of the person

birthDate

String

Date of birth of the person

resourceType

String

Type of the resource

PersonAddresses:

registry

Object

Object containing registry address

Registry:

city

String

City name

country

String

Country name

postalCode

String

Postal code

street

String

Street name and number

Accounts:

id

String

Unique identifier of the account.

number

String

Account number.

name

String

Account name.

openedAt

String

Date when the account was opened.

currency

String

Currency of the account.

availableBalance

Number

Available balance in the account.

bookingBalance

Number

Booking balance in the account.

overdraftLimit

Number

Overdraft limit of the account.

bic

String

Bank Identifier Code of the bank where the account is held.

bankName

String

Name of the bank where the account is held.

transactions

Array

List of transactions associated with the account.

Transactions

id

String

Unique identifier of the transaction.

accountId

String

Unique identifier of the account associated with the transaction.

amount

Number

Amount of the transaction.

currency

String

Currency of the transaction.

title

String

Title of the transaction.

tradedAt

String

Date and time when the transaction was made.

status

String

Status of the transaction.

accountNumber

String

Account number of the counterparty.

description

String

Description of the transaction.

bookedAt

String

Date and time when the transaction was booked.

counterpartyAccount

String

Account number of the counterparty.

counterpartyName

String

Name of the counterparty.

counterpartyBic

String

Bank Identifier Code of the counterparty.

counterpartyBankName

String

Name of the counterparty bank.

category

String

Category of the transaction.

postTransactionBalance

Number

Balance after the transaction was made.

Example response

Was this helpful?